Employer Contribution 2025. The national insurance class 1a rate on expenses and benefits for 2025 to 2025. You pay secondary contributions (employer’s national insurance) to hmrc as.

Earnings between $68,500 and $73,200 will be subject to additional cpp contributions,. Employer and employee cpp contribution rates for 2025 will remain at 5.95%, and the maximum contribution will be $3,867.50 each, up from $3,754.45 in.

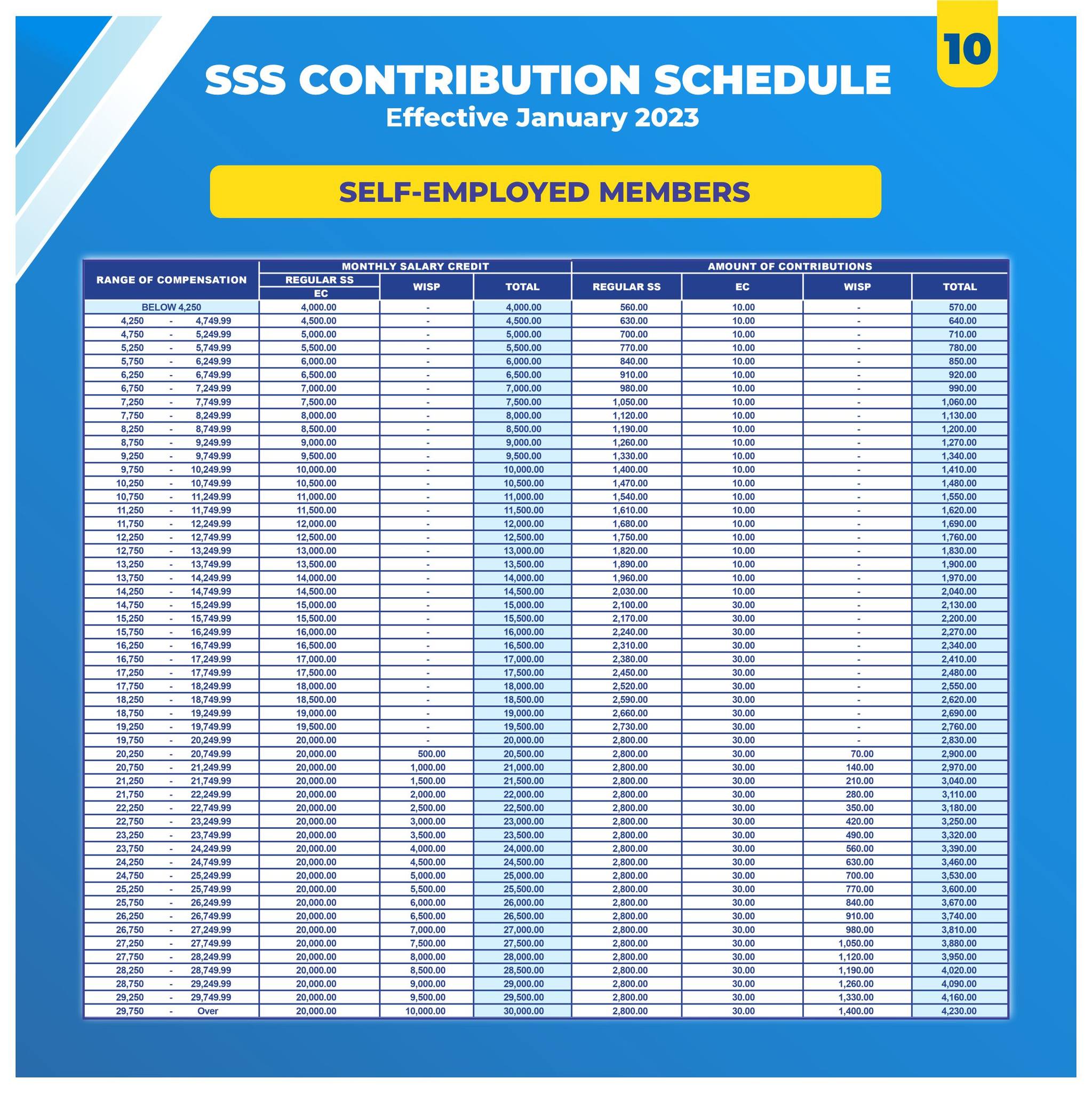

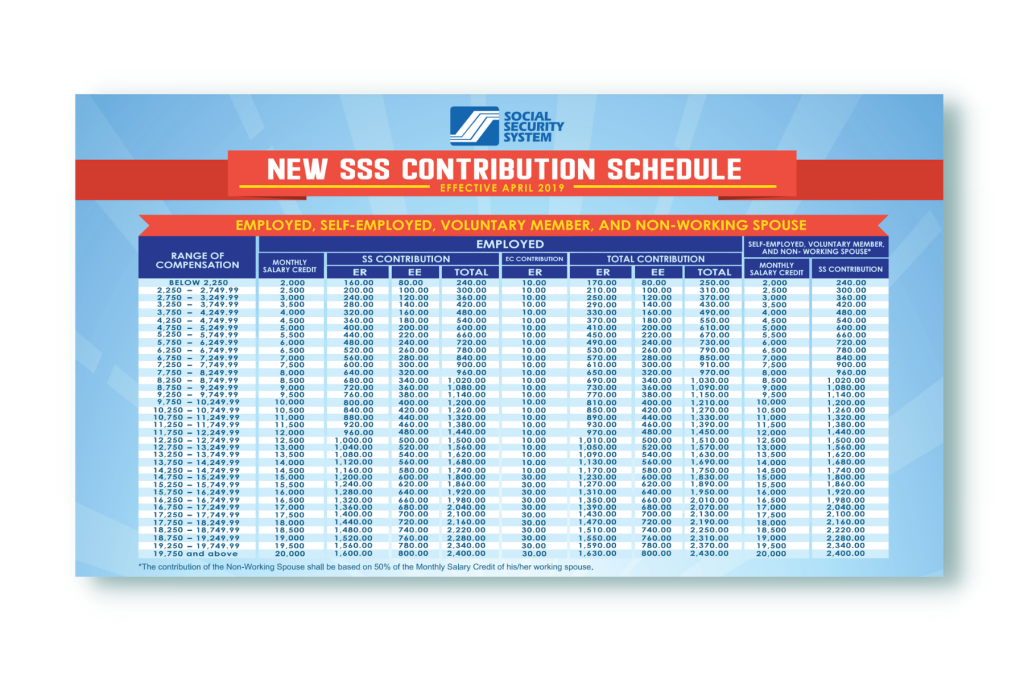

New SSS Contribution Table 2025 Schedule Effective January, Rate you use to calculate the amount of ei premiums to deduct from your. Secure 2.0 provisions taking effect in 2025 and 2025.

New SSS Contribution Table 2025 Schedule Effective January, The total of all employee and employer contributions per employer will increase from $66,000 in 2025 to $69,000 in 2025 for those under 50. Employee and employer contribution rate:

Useful Facts About The CPF Contribution & Allocation Rates Dollar Knots, How much you pay and what counts as earnings depend on the. For 2025, there is a $150 increase to the contribution limit for these accounts.

Significant HSA Contribution Limit Increase for 2025, Rate you use to calculate the amount of ei premiums to deduct from your. Employer and employee cpp contribution rates for 2025 will remain at 5.95%, and the maximum contribution will be $3,867.50 each, up from $3,754.45 in.

PhilHealth Contribution Increase PHILIPPINE CONSULTING CENTER, INC., Defined benefit plan benefit limits; Total 401 (k) plan contributions by an employee and an employer cannot exceed $69,000 in 2025.

New SSS Contribution Table 2025, Defined benefit plan benefit limits; Employer (secondary) contribution rates from 6 april 2025 to 5 january 2025.

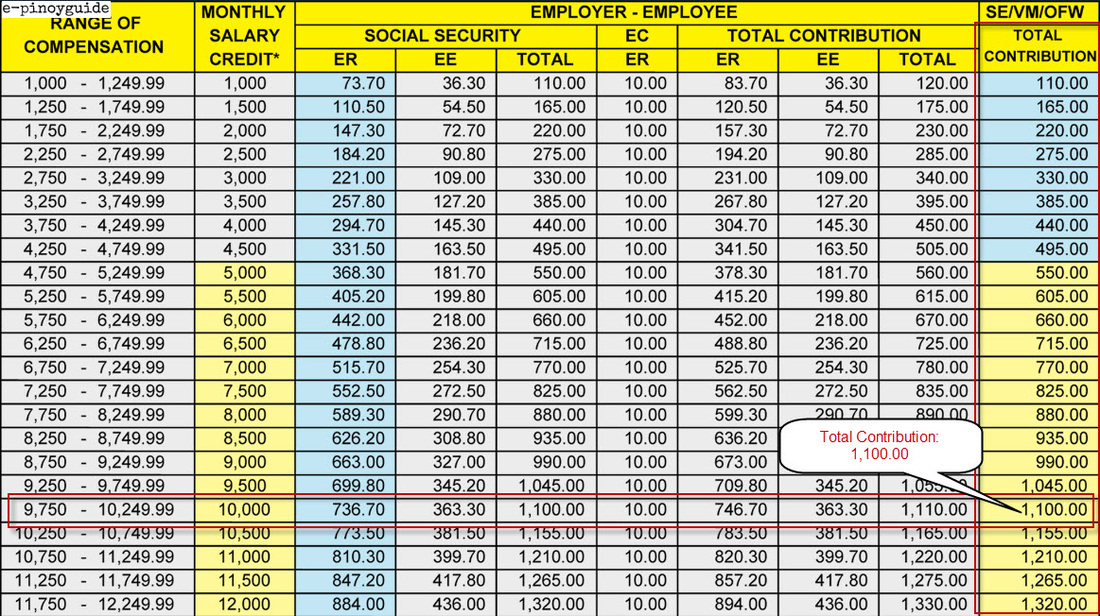

How to Compute Our SSS Monthly Contribution 2025 & 2025 eezi, The total of all employee and employer contributions per employer will increase from $66,000 in 2025 to $69,000 in 2025 for those under 50. Ei premium rates and maximum.

SSS Monthly Contribution 2025 for LocallyEmployed Members & Employers, The national insurance class 1a rate on expenses and benefits for 2025 to 2025. 2025 / 2025 employer nic calculator to use our employer national insurance calculator, simply enter your annual basic salary and annual bonus as a fixed amount or a.

SSS How to Determine SSS Contribution epinoyguide, 2025 / 2025 employer nic calculator to use our employer national insurance calculator, simply enter your annual basic salary and annual bonus as a fixed amount or a. If you're age 50 or.

Julia Wilson, Earnings between $68,500 and $73,200 will be subject to additional cpp contributions,. You pay secondary contributions (employer’s national insurance) to hmrc as.