2025 Educator Expense Deduction. Eligible educators can deduct from their federal income taxes up to $300 of unreimbursed expenses from 2025 for books, supplies,. If you’re a teacher, instructor, counsellor,.

Eligible educators can deduct from their federal income taxes up to $300 of unreimbursed expenses from 2025 for books, supplies,.

Educator Expense Deduction 2025 2025, Thomson reuters tax & accounting. Education tax credits for 2025.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, This client update discusses the 2025 educator expense deduction. Educators expense deduction modernization act of 2025

Spend Smarter Maximizing Tax Deductions in 2025, Education tax credits for 2025. Solved•by turbotax•7262•updated december 09, 2025.

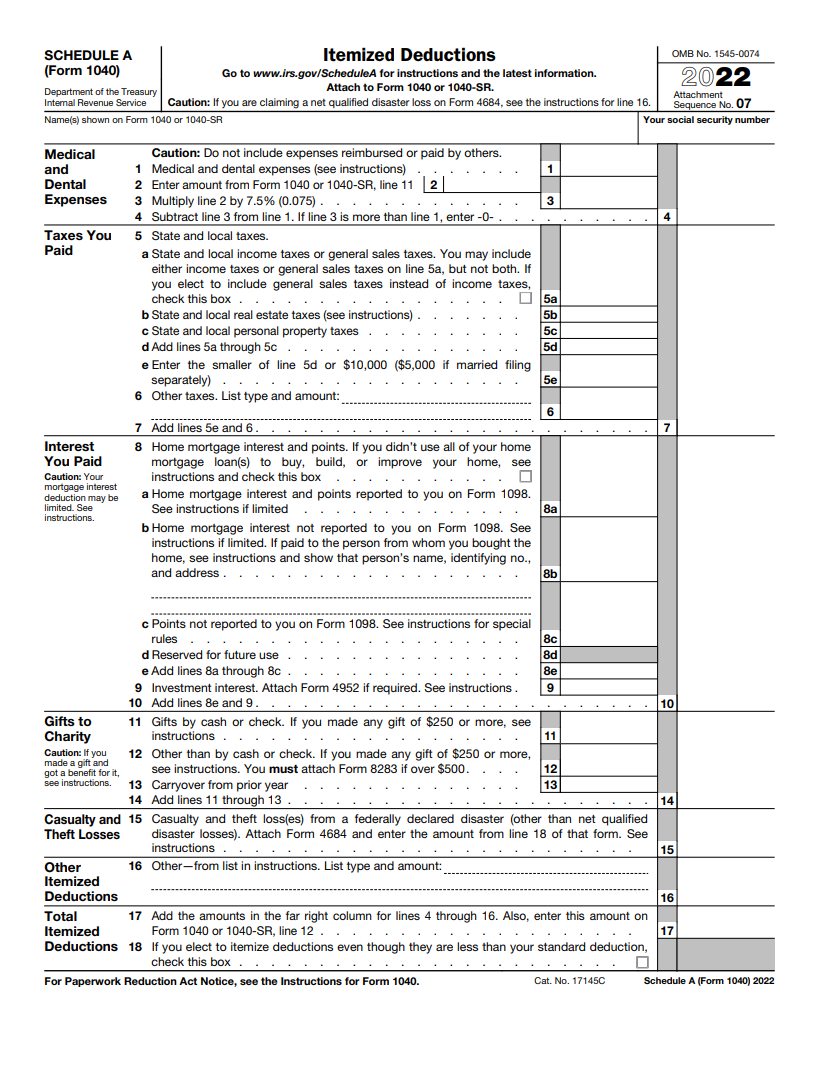

Schedule A (Form 1040) A Guide to the Itemized Deduction Bench, Educators expense deduction modernization act of 2025 2025 brings with it “changes to the educator expense deduction limits,” a critical update that could reshape the tax landscape for teachers.

Educator Expense Deduction 2025 2025, Eligible educators may deduct up to $300 ($600 if both spouses are eligible educators and file a joint return) of unreimbursed qualifying trade or business expenses. For the current tax season (i.e., the 2025 tax year), the maximum educator expense deduction is $300.

New Standard Deductions for 2025 Taxes Marketplace Homes Press Release, The educator expense tax deduction is available for various education professionals who meet specific criteria. To help offset some of those expenses, the educator expense deduction allows them to deduct up to $300 of unreimbursed expenses ($600 if married filing jointly.

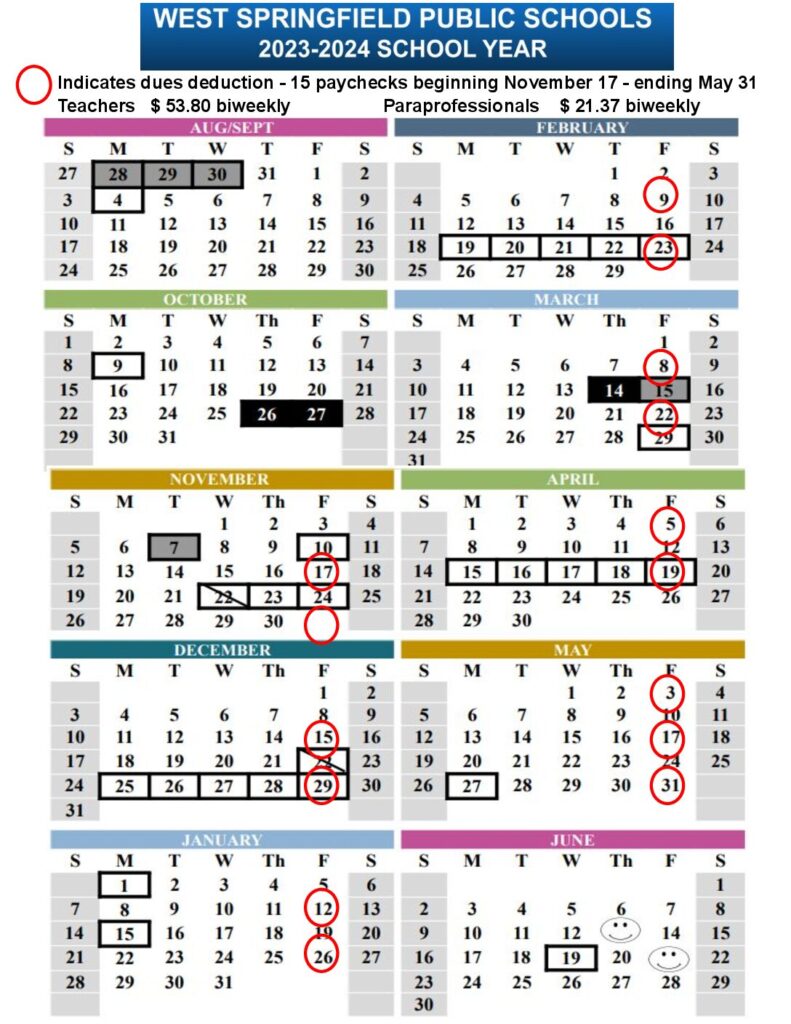

Dues The West Springfield Education Association, Education tax credits for 2025. If you're a teacher, instructor, counselor,.

Educator Expense Deduction 2025 2025, Solved•by turbotax•7262•updated december 09, 2025. Educator expense deduction amount 2025.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, For the current tax season (i.e., the 2025 tax year), the maximum educator expense deduction is $300. The good news is that a new tax deduction may help them get some of this money back.

The IRS Just Announced 2025 Tax Changes!, For the current tax season (i.e., the 2025 tax year), the maximum educator expense deduction is $300. 2025 brings with it “changes to the educator expense deduction limits,” a critical update that could reshape the tax landscape for teachers.

The big tax news for educators this year is that the internal revenue service has expanded the educator expense deduction , from $250 to $300.

Effective for the 2025 tax year, educator expense deduction lets educators and certain other workers claim up to $300 of.